At a global level, the butadiene demand has grown lower than the world GDP growth. Butadiene Market is not very closely related to GDP growth like that of commodity polymers that are directly correlated to economic growth. Most of the butadiene is produced a by-product/ co-product and various other factors including the production of ethylene and demand from other end-use industries cause a change in butadiene trade dynamics.

Crude C4 supply patterns are somewhat different between various regions and countries. In Asia, and Europe naphtha is the most common feedstock while in North America, steam cracker feed slates can vary depending on relative production economics.

Over 95 percent of the butadiene is produced as a byproduct of ethylene production from steam crackers and recovered via extractive distillation. In certain parts of the world, there are still some production units based on on-purpose routes and this is expected to grow in the long-term forecast.

The supply of mixed C4s and butadiene is not driven by its consumption but also the consumption and production of Olefins as butadiene is mostly a co-product. Historically the butadiene market was either oversupplied or undersupplied. The market has never been balanced. During a situation of the deficit, butadiene is mostly extracted from the C4s produced by the steam cracker while during ample supply, producers use different mechanisms for processing C4s with associated values without producing Butadiene. This trend of not so balanced market will continue in the forecast period through the market will approach a nearly balanced scenario.

As most of the global butadiene is produced by extracting it from crude C4s which are produced as result of cracking heavy feedstock such as naphtha. As the crackers are shifting towards lighter feedstocks it is believed that the butadiene production from ethylene co-productions will become insufficient which will led to an increase in on-purpose butadiene production. This will most likely push the butadiene prices upwards as more on-purpose butadiene capacities come on-stream.

In the last 5 years, On account of the shale gas advantage, the crackers in the US have switched to lighter natural gas-based feedstocks leading to a decline in C4 production. In China, new on-purpose butadiene production through the oxy-dehydrogenation process is likely to come upon a commercial scale. Hence during the forecast period, on-purpose technologies are expected to be important though its economics are higher in the current scenario.

The global automotive industry has fully recovered from the economic recession of 2008 -2009 and the sales and profit have been higher than the pre-crisis level right from 2012 onwards. The major drivers of the butadiene industry include an increase in the automotive and tire industry.

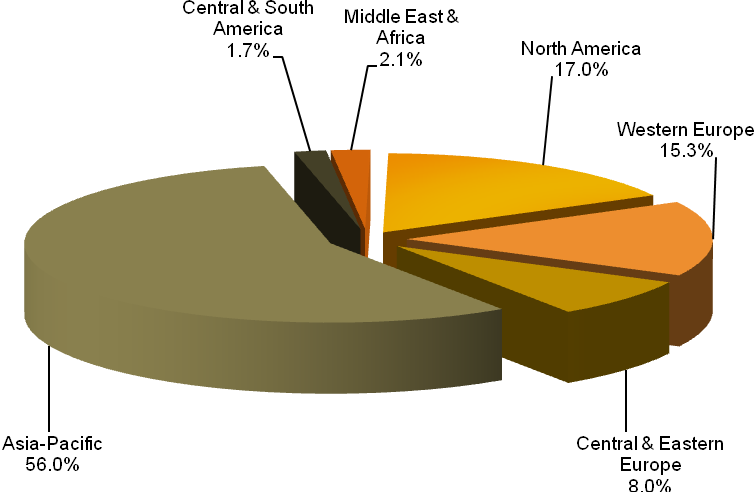

There has been a shift of the automotive industries and market from Western Europe and the USA to Asia-Pacific.

China, India and South Korea are expected to witness strong growth in the automotive sector which will drive the demand for butadiene derivatives.

Strong automotive sales in North America and Asia-Pacific countries like China and along with increased demand for electric vehicles are expected to be key demand drivers for butadiene derivatives.

In 2018, SBR applications constituted the largest demand for butadiene accounting for nearly 29% of the total demand followed by PBR accounting for around 24% of the total demand. ABS end-use together accounted for about 15.7%. All other applications including adiponitrile, nitrile & polychloroprene elastomers and others constituted between 5% to 8% each of the total demand.

For More Report :- https://prismaneconsulting.com/reports